The Economics and Politics of Urban Water System Reform. Mary Shirley (ed.) Pergamon/Elsevier, 2002

The performance of Conakry's water system, which had been deteriorating since independence, had become critical by the mid-1980s. The public agency in charge of the sector, the Enterprise Nationale de Distribution de l'Eau Guinéenne (DEG) was inefficient, overstaffed and virtually insolvent. Less than 40% of Conakry's population had access to piped water – low even by regional standards — and service was intermittent, at best, for the lucky few with connections. By 1983, residents had to line up at neighbors' connections and standpipes for hours, hoping for service. Many residents used polluted well water as their primary source of drinking water and even more relied upon it as a secondary source when the piped system was not operating. Consequently, water-borne diseases, including cholera and diarrhea, had become a major problem. Further, after disappointing results from previous investment projects, international donors were becoming frustrated. The poor, and deteriorating, performance of the sector convinced many observers that significant reform was necessary.

In 1989, after several years of discussions and delays, the government signed a lease contract with a majority privately owned enterprise that covered operations and maintenance of all urban water systems in Guinea. A newly created public enterprise was given ownership of sector assets and responsibility for investment. At the same time, a large World Bank-led project, the Second Water Supply Project, was approved, allowing for expansion and rehabilitation of the system. In several ways, the reform was quite remarkable, requiring significant commitment from private investors in an institutional setting that imposed few limits on arbitrary government action. Further, informal constraints, such as traditions of regulatory or bureaucratic independence, were also weak. The World Bank, which was heavily involved in the design and implementation of the contract, had to implement new internal procedures to handle the arrangement and it was not clear to the partners how well the system would work. Although DEG's disastrous performance made the reform desirable, sector-specific crises have often been insufficient motivation for private participation. In Guinea, four additional factors encouraged substantial change. First, DEG's poor management and performance, rather than less tractable problems such as scarcity or expensive raw water, were the main reasons for the sector's problems. Consequently, the introduction of private sector participation could be expected to improve the situation. Second, the military government that came to power following the death of President Sékou Touré did not rely heavily upon support from the urban elite who were used to receiving free water. This allowed the government to implement large price increases, allowing tariffs to cover operating expenses and provide a fair return on capital. Third, privatization was consistent with the Government's philosophy of liberalizing and privatizing the economy, which was demonstrated by the structural adjustment program that it was implementing in response to the macroeconomic crisis that hit Guinea in the mid-1980s. Finally, bilateral and multilateral donors, who were pushing for reform, had significant leverage, since in addition to financing the structural adjustment program they also financed most sector investment.

Although the weak institutional framework did not prevent the private sector from becoming involved in the sector, it affected the success of reform. In practice, no independent body existed that was able to enforce the contracts between the various parties involved in the sector and the government. Consequently, many useful contract provisions were ineffective (e.g., provisions requiring that the government pay its water bill, allowing for international arbitration in the case of dispute between the partners, and enforcing performance targets). Further, in the absence of a neutral party that could mediate disputes and enforce its decisions, disagreements between the different parties had to be settled at the highest levels of government. These problems slowed sector development and poisoned relations between the public enterprise that owns sector assets, the private operator and the government. For example, one of the main reasons that the price of water became high was that the collection rate remained low due to the Government's refusal to pay its water bill and to the weak judicial system that made it difficult to collect from private consumers who refused to pay.

Notwithstanding these problems, the bottom line from this study is that all parties have benefited from reform. On aggregate, increased coverage and improved quality more than compensated consumers for higher prices. Further, government subsidies were reduced and the foreign investors made modest, but positive, profits. Under the circumstances, it is unlikely that the public operator, DEG, would have had greater success than the private operator had – especially given its disastrous record before reform and the poor compliance with provisions in the public enterprise's contract. This shows that even in a weak institutional environment, where contracts are hard to enforce and political interference is common, private sector participation can improve sector performance.

This chapter discusses the mechanisms that makes progress possible, even in difficult institutional environments, and identifies factors that inhibit the potentially positive effects of reform. The next section describes the situation in Guinea before reform. The third section describes the sector crisis at the time of reform. The fourth section examines the political economic circumstances that affected the decision and the design of reform. The fifth section analyzes the contractual arrangement and its implementation. The sixth section evaluates the outcome. The seventh section goes beyond standard performance measures and presents results from a detailed cost-benefit analysis. The final section concludes and discusses options that might improve sector performance.

In many ways, the collapse of the water system mirrored a collapse in Guinea's economy, and many of the problems that affected DEG affected the entire public sector. By the time that reform was enacted in 1989, Guinea, with a per capita GDP of US $430, was one of the poorest countries in the world (World Bank 1990d). Further, life expectancy at birth (43 years) and the infant mortality rate (143 deaths per 1000 births) were both below the average for Sub-Saharan Africa (51 years and 108 deaths per 1000 births). This was not due to a lack of natural resources. In fact, due to its vast mineral wealth and its fertile land, Guinea had been seen as one of the most promising colonies in French West Africa before independence. Instead, Guinea's problems were primarily the result of years of economic mismanagement by the dictatorial regime led by President Sékou Touré. Before independence, due to vigorous campaigning by Sekou Touré and the Parti Démocratique de Guinée (PDG), which dominated pre-independence politics, Guinea rejected membership of the French Community proposed by General de Gaulle. This prompted an immediate withdrawal of French expatriates and a swift end to technical assistance, budgetary aid, and trade preferences. Since the PDG held the majority of seats in the regional assembly, Sekou Touré automatically became President. He used his position to set up a one-party state, introducing ‘African Socialism' and imposing a dictatorship based on personal and clan ties. President Touré's fear of being overthrown – known as the permanent plot – resulted in the arrest, persecution, and torture of any real, or imagined, opponents. The Touré regime's policies led to state domination of the economy and urbanization. Following independence, most enterprises were nationalized and cooperative farms were set up in rural areas. To subsidize urban consumption, the government suppressed private trade of agricultural products and forced farmers to sell their produce at prices that by 1984 were lower than the estimated cost of production (Arulpragasam and Sahn 1997). The long-term results were predictable. People living in rural areas withdrew from the state by turning to barter, subsistence farming, smuggling and the black market (Azarya and Chazan 1986). Meanwhile, agricultural production and exports fell dramatically 1.

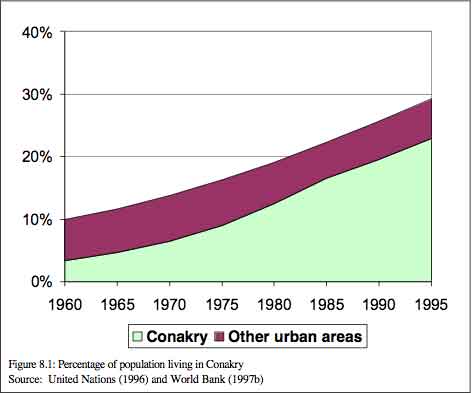

These policies also encouraged fast population growth in urban areas. Between 1960 and 1985, Conakry grew from around 39,000 people (3.5% of the population) to over 800,000, almost 16.5% of the population (See Figure 8.1). Although, the estimated growth rate slowed in the late 1980s and early 1990s, it remained fast due to an influx of refugees from neighboring Sierra Leone and Liberia. Rapid population growth, combined with poor urban planning and inadequate investment, quickly overwhelmed Conakry's infrastructure, including its water system 2. Despite the strong performance of the partly foreign-owned and run mining sector, the Guinean economy rapidly deteriorated. Rapid expansion of the civil service led to a huge public sector wage bill, even though salaries were falling in real terms 3. Although wages were supplemented with benefits such as access to goods at official prices, transportation allowances, and access to free piped water, it became nearly impossible to support a family on a civil servant's salary. Consequently, civil servants turned to corruption and moonlighting to make ends meet 4. In addition to increasing government size, these policies also increased the influence of the PDG.

Price controls, rationing and control of production greatly increased the potential for patronage, making links to the PDG a way of gaining access to jobs, rations at official prices, education and connections to the water system 5. Foreign exchange obtained from the sale of cash crops was used to subsidize the consumption of civil servants and party officials, while low subsidized prices for food crops benefited urban consumers. Since both the civil service and the PDG were concentrated in Conakry, President Touré became reliant upon urban areas for support. Although protests in 1978 resulted in modest liberalization, the pace was predictably slow since many of the reforms (e.g., privatization, civil service reductions and price liberalization) would harm his urban supporters 6.

On March 24, 1984, during preparations for the upcoming meeting of the Organization for African Unity (OAU) in Conakry, President Touré had a heart attack, dying two days later. President Touré's notorious fear of plots meant that there was no clear successor and, therefore, a lengthy power struggle seemed likely. The process, however, was cut short on April 3, when several top army officers, led by Colonel (now General) Lansana Conté, seized power. The new government quickly consolidated power, sweeping away the remnants of the Touré regime – the Parti Démocratique de Guinée (PDG) and the unions were outlawed and political prisoners were released. After years of repression, the new regime received widespread support from the public, signaled by huge and festive demonstrations. Because of this goodwill, and because it did not depend upon urban areas for support, the new military government could consider policies to liberalize the economy that had been rejected or delayed by the Touré regime.

In 1983, while President Touré was still president, a group of international experts was invited into Guinea to evaluate Conakry's water system and to suggest ways of improving sector performance 7. By this time, sector problems were critical. Despite loans from international donors, coverage was low and many non-connected residents drank polluted water from wells. Because of this, waterborne diseases were the main cause of death for infants and children and there were periodic cholera epidemics. The public enterprise responsible for the sector, the Enterprise Nationale de Distribution de l'Eau Guinéenne (DEG), was poorly managed, overstaffed, and practically insolvent. Although the report suggested several options for reform, and despite pressure from international donors and the system's deteriorating performance, the government did not enact reform until 1989. In this section of the chapter, we describe the situation prior to reform and discuss reasons for the sector's poor performance.

Prior to reform, a public agency, the Enterprise Nationale de Distribution de l'Eau Guinéenne (DEG) was responsible for operations, maintenance and investment in Conakry and other urban areas. Theoretically, DEG was an autonomous agency within the Ministry of Natural Resources and Environment (MNRE) and, under its statutes, its board contained representative from several ministries. However, in practice, its board never met and the MNRE treated it as it would any other department (Triche 1990). Consequently, DEG had no autonomy and suffered from the same problems that plagued the rest of the civil service during President Touré's regime. For example, the policy of guaranteeing employment to university graduates meant that DEG, like the rest of the civil service, was extremely overstaffed.

Despite the sector's problems, scarcity has never been a major problem in Guinea, which, due to its abundant rainfall, has earned the reputation of being the ‘water tower of Africa' 8. Although water from the Conakry aquifer is unsuitable for drinking because it is highly polluted, due to the use of pit latrines, and saline, due to proximity to the ocean, a safe source of abundant fresh water is available.

The reservoir at Grandes Chutes, which is located about 60km from the city, could produce over 500,000 m3/day (World Bank 1989). In comparison, DEG's average production in Conakry was only 44,000 m3/day in 1985 and total production remained at only 68,000 m3/day in 1996 (World Bank 1987 and 1998). Further, because Grandes Chutes is located 233 meters above sea level, the system can be gravity-fed, reducing the cost of water. Although potential production was high, the transmission pipeline from the Grandes Chutes dam, which could carry only 45,000m3/day, limited actual productive capacity.

Despite the abundant water supply, coverage was low before reform – we estimate that less than 40 percent of the population of the city had access to piped water in 1989 9. According to data from SEEG, there were 3,100 legal unbilled connections for deputies, senior civil servants and DEG employees and 10,200 billed connections in 1989 for close to one million people. In comparison, Abidjan in Côte d'Ivoire, which was about twice the size of Conakry, had over 111,505 connections (SODECI 1990). Most private connections were a single tap inside a lot or compound – only a small wealthy minority had running water inside their house – usually serving many households (Durany and Morel à l'Huissier 1994). According to field interviews, whether a household had a connection depended primarily on personal links (e.g., tribal and family) and fidelity to the Sekou Touré regime. For this reason, a household's capacity to provide water to neighbors rapidly became part of its power, prestige, and control. Although it is difficult to estimate the exact number, many Conakry residents had illegal connections to the system. In 1992, three years after the private operator took control of the company, Castilia (1993) estimated that there were 4000 illegal connections in Conakry, compared to 13,371 legal connections 10. Since a private operator, operating along commercial lines, presumably has greater reason to reduce the number of illegal connections, it is likely there were significantly more illegal connections before reform.

In part, the low connection rate was the result of rapid urban growth due, in part, to policies that encouraged urbanization. Problems related to fast growth were exacerbated by poor urban planning, something that remains a problem today. Service delivery and system expansion were difficult and costly because the poor road network made it difficult to lay pipes and because a relatively small number of potential customers were spread over a wide area. Consequently, even if maintenance had been adequate, Conakry's infrastructure would have been strained beyond its capacity.

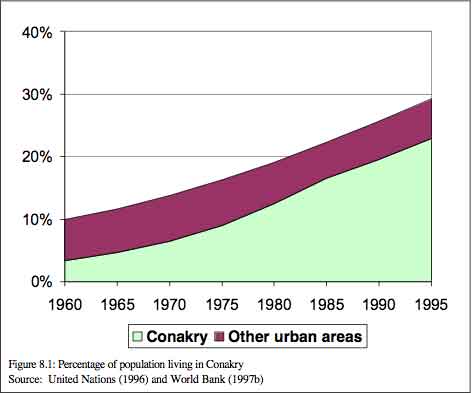

Before June 1986, when it was increased to GF 60/m3 ($0.12/m3), the water tariff was GF 10/m3 ($0.02/m3). Even after the increase, the tariff was considerably lower than prices in other West African countries (see Figure 8.2) and far lower than estimates of long-run marginal cost. Based upon DEG's actual expenses and estimates of the optimal level of operating and maintenance costs, World Bank (1987) estimated that the average incremental cost of water (AIC) was about US$0.25/m3.

However, even this might have been somewhat low, given that in 1989, World Bank (1989) estimated that the AIC in Conakry was US$0.82/m3 11. Because of this, it would have been difficult for even an efficient operator to operate and maintain the system at the tariff levels in place before reform. Since, as we discuss below, DEG was overstaffed, inefficient, and hopeless at billing and collection, there was little money available for either maintenance or system expansion.

By 1984, DEG had 504 employees nationally, a ratio of 34 employees per 1000 connections (World Bank 1987) 12. Even compared to other West African public water utilities this was high – there were 32 and 24 employees per 1000 connections, respectively, in the public utilities in Togo and Benin. The private operator in Côte d'Ivoire, SODECI, had only 9.8 employees per 1000 connections at this time (SODECI 1986). Further, Guinea's severe financial problems led to a serious decline in civil service salaries, including salaries at DEG, in the 1970s and 1980s. Because of this, DEG employees had little or no incentive to do their job and many would show up only to collect their salaries, which were often paid in cash.

In principle, water distribution was metered and consumers were charged according to consumption but, in fact, metering was rare. Despite a $12 million IDA loan in 1979, which included a component intended to increase the number of connections and the extent of metering, only 5% of connections had a working meter in 1984 13. Few private customers willingly paid for water and many were not billed at all – the 1985 consultant report estimated that less than 12% of private users were billed in 1982. For the few customers that were billed, the highly political nature of water prevented DEG from collecting. For example, in 1987, DEG billed customers for approximately GF 800 million, but collected only about GF 100 million (World Bank 1989). Since the private billing and collection rates were so low, DEG relied upon infrequent payments and subsidies from the Government. However, even this was unreliable, and non-payment by the government often led to conflict with donors 14.

Since DEG did not comply with international accounting standards, did not have audited accounts for most of the 1980s, and maintained poor records and data collection standards, it is difficult to assess DEG's financial performance before reform 15. However, given that DEG maintained poor commercial habits and that tariffs were set below long run marginal cost, it is not surprising that DEG appears to have had serious financial problems by the time of reform. One indication of this is that DEG owed over US$4 million in unpaid interest and was over US$14 million in debt by 1984. Another is that, even according to DEG's own accounts, it was losing large amounts of money. In 1988, DEG's total operating revenues (i.e., amount billed) were about GF 938 million ($2.6 million in 1996 dollars) and its total loss (i.e., retained earnings) was GF 805 million ($2.0 million in 1996 dollars). This probably understates DEG's actual losses, since actual collections were significantly lower than billed water sales.

In addition to affecting the coverage rate, DEG's troubled financial state had a large effect on water and service quality. Although it is difficult to find reliable data – DEG did not collect information on service interruptions, water pressure or the time it took to repair breaks – by all accounts, water and service quality were poor. Since water was often delivered through poorly maintained lead pipes and was not isolated from the environment, it was heavily polluted 16. Consumers would have to run the water several minutes before it was “clear” enough to appear drinkable. Constant service interruptions meant that even households with piped water had to use polluted water from wells as secondary source of drinking water 17. In addition, this meant that residents would have to store water for long periods, often in unhygienic conditions (i.e., open buckets in an expanding city with almost no sewerage system).

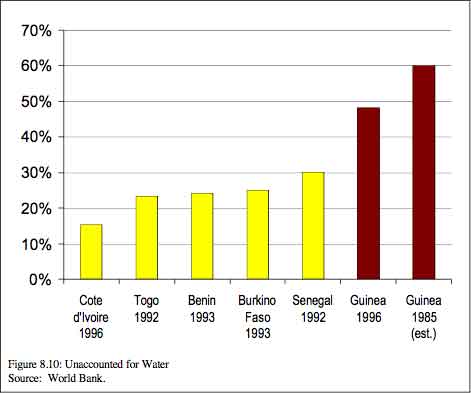

Poor maintenance due to DEG's weak financial position and the large number of illegal connection also resulted in high levels of unaccounted for water (UFW). Although the lack of metering makes it difficult to estimate UFW, most estimates were very high. According to the 1985 audit report, UFW was at least 60% in 1983 – high compared to standards for well-developed systems (between 10 and 20%) or to other water systems in West Africa (see Figure 8.10) 18.

In 1992, almost one-fifth of households reported that they got piped water from a neighbor's connection 19. Alternative sources, such as bottled water, were almost nonexistent. Before reform, state control prevented private initiatives to supply water. But even by 1993, nearly ten years after President Touré's death, less than 1% of households purchased water from vendors and less than 5% purchased water from connected neighbors (Durany and Morel à l'Huissier 1994). Many households used rainwater for uses other than drinking (e.g., for washing dishes and bathing), especially during the rainy season. However, it was often stored in unsanitary conditions. Most non-connected residents relied upon neighbors' connections or water from wells. In 1992, 29% of Conakry residents relied upon well water as their primary source of drinking water and, as noted above, many others used it as a secondary source when the system was not working. Because the sewerage system was also undeveloped, well water was heavily polluted 20.

Although the sewage system was, and remains, underdeveloped, it has always been separate from the water supply system 21. Consequently, the 1989 reform did not have a significant effect on the sector, other than through its indirect effect on water supply. In 1992, 89% of households relied upon primitive sewage facilities in their courtyard. 21% of these facilities were simple unlined pits, 39% were pits lined with cement, and 29% consisted of two separate pits (Durany and Morel à l'Huissier 1994).

Sludge from these pits can leak into the phreatic layer, from which households draw well water for daily activities such as washing dishes and bathing and can be close to leaking pipes that provide water to households and public fountains.

Given the weak institutional framework and the dire situation of the water system, the reform ended up being quite radical, especially in a sector that is politically sensitive and where full privatization is rare. Operational control of the system was transferred from a state-owned enterprise that was only nominally independent of the government ministry it reported to, to a private-sector company that was owned and controlled by foreigners. In addition, significant price increases were planned (over 500% in real terms over a five-year period) and even greater increases were implemented (over 600%). Despite the collapsing system, however, the government took a long time to implement reform. Before reform was finally enacted, six years passed and a change of government took place. In this section of the chapter, we discuss why the reform occurred, why it took the form it did, and why it took so long to enact.

Although the crisis in the water sector made reform highly desirable, in many other cases sector-specific crises have failed to motivate significant reform. For example, over the past decade, some parts of downtown Mexico City have sunk two meters due to the overexploitation of groundwater resources. Despite this, the government implemented only a minor reform, which failed to reduce costs or curb waste (Haggarty et al. 2001). Although problems in Conakry, which were primarily the result of the poor performance of the public operator, were far more tractable than the problems in Mexico City, poor performance alone has often failed to motivate significant reform.

Theoretically, the government could reform the sector in many different ways: however, its practical options were constrained. The main problem was that if sector performance were to be improved additional funds would be needed to allow the operator to cover its costs and to increase investment. The 1985 consultant's report estimated that, at that time, US$73 million of investment was needed to increase production capacity and repair and extend the distribution network. Although in theory these funds could be obtained in several different ways – for example, through additional borrowing, through increased subsidies or through higher tariffs – in practice the government had only limited options. Given that the government's finances remained weak due to the disastrous economic policies of the previous regime, the government could not finance the needed investment without help from donors. However, donors led by the World Bank demanded ‘full cost recovery' (i.e. setting tariffs to cover operating costs and support sector debt service) (Triche 1990). To get access to donor funds, the government would therefore have to increase prices significantly 22.

The need for support from donors and international organizations, due to the pressure that the macroeconomic difficulties put on public finances, limited the government's options in other ways. Most importantly, the poor performance of the First Conakry Water Supply and Sanitation Project convinced the World Bank that significant institutional reform, including some private sector participation, was necessary (World Bank 1987). The government, therefore, found that it would have to accept this if it were to receive aid. Other factors also encouraged private sector participation. The government recognized that reforming DEG without increasing private participation would have been extremely difficult. Even with technical assistance from abroad, entrenched interests and existing corruption would make some tasks, notably bill collection, difficult if DEG remained in charge of the sector. The decision to allow private sector participation also reinforced the decision to allow price increases. Since the government was, and remains, delinquent in paying its bill, a private operator would have been wary about relying on government subsidies, especially given the poor state of public finances and the weak institutional environment. Consistent with this, the part of the price subsidy that went to the private operator for the first few years following reform was funded through a World Bank loan, rather than from general government revenues.

An additional factor that encouraged private sector participation was that it was consistent with the governments' philosophy of liberalization and privatization. The structural adjustment program that the government implemented in response to the macroeconomic crisis greatly increased the private sector's role in the economy. In this respect, increased private participation in water was part of a larger program to increase the importance of the private sector in the economy.

By restricting possible reform options, these constraints threatened the feasibility of reform. Price increases and private sector participation would have a significant effect on two powerful groups – the urban elite who were used to not paying the full cost of water and workers who might lose their jobs. Reform would only be possible to the extent that the government could either ignore these groups without threatening its support base or compensate them for their losses.

In practice, neither the urban elite nor public workers were vital supporters of the new military government. The clearest demonstration of this is that, in response to the macroeconomic crisis, the government enacted a structural adjustment program that harmed these groups significantly. Within days of assuming power, the military government announced that it intended to speed up the liberalization process. The focus of the proposed reform package was improving the performance of the agricultural sector, reducing the size of the public sector and liberalizing prices and exchange rates 23.

The stress on agricultural production, which would initially benefit rural areas, was a marked contrast to the Touré regime's policy of favoring its urban constituents 24.

The new government began initiating its agenda several months after coming to power. Prices were liberalized, the overvalued exchange rate was realigned, the state-owned marketing boards and stores were closed and many state-owned enterprises were privatized or liquidated. Although in the medium-term it was hoped that structural adjustment would benefit all Guineans, it was clear that these reforms would cause significant short-term pain for many urban residents. This would be especially acute for higher-level officials who had better access to goods at official prices – the same group who had access to free or low-cost water 25.

The structural adjustment program, which resulted in many layoffs, also harmed public sector employees. Employment in state-owned enterprises fell from 17,111 in early 1986 to 2,000 by the end of 1989 and civil service employment fell from 70,989 in early 1986 to 51,000 by the end of 1990 26. These massive layoffs were painful for many Conakry residents, since 24% of employed workers (and 30% of employed male workers) in Conakry worked in public sector in 1990 (Arulpragasam and Sahn 1997) and the poorly developed private sector was not able to quickly absorb laid-off workers 27.

In contrast, urban water reform would not greatly affect the Government's main supporters. The army, who were the most important supporters of the government, would be largely unaffected by reform 28. Further, rural consumers, who were expected to be the main beneficiaries of structural adjustment, did not have access to piped water and, therefore, reform would mainly affect them through its effect on government finances.

Although water sector reform would be painful for many DEG employees and customers, it is important to note that some members of these groups would benefit from reform. First, the government's, and DEG's, weak financial position meant that employees could often not rely upon receiving wages in a timely manner. DEG employees who found jobs in the new private enterprise might therefore benefit from reform. Similarly, although current DEG customers would have to pay higher prices, they would benefit from improved service and water quality. Consequently, not all DEG employees and current customers could be counted as losers.

The government also took steps to reduce opposition from current DEG customers and employees. First, the government, with support from the World Bank, agreed to subsidize prices during the early years of reform. Although price increases were implemented immediately, they were far smaller than would be needed to cover sector costs. Second, the Government, again with World Bank support, compensated DEG employees who were not selected for jobs at SEEG or SONEG. Of 504 DEG employees, 40 were hired by SONEG, 250 by SEEG, and 30 qualified for other civil service positions (Triche 1990). Additional persons retired or moved to other jobs in the formal sector.

Remaining employees were offered basic equipment and special training, organized and monitored by the Compagnie Générale des Eaux, to help them create and develop cooperatives specializing in public works. Notwithstanding severe tension, this made reform acceptable to most employees.

Within the general framework of increased prices and private sector participation, the government had several options. The 1985 consultants' report considered possibilities ranging from a management contract to full privatization. In the end, the government decided on a mixed scheme with a public enterprise owning and developing infrastructure and a mixed company, dominated by the private sector, in charge of operating the system. It chose this rather than full privatization for several reasons.

First, it was thought that private enterprises might not be willing to invest in the development of infrastructure. Although the current government was committed to reform, the political situation was unstable: several coups had been attempted and civil unrest was pressuring the government to become more democratic. Further, although Guinea was trying to increase the competence and independence of the judiciary, the judiciary was weak and heavily dependent upon the executive 29. Because of this, and because of the weak system of property rights, the judiciary had a poor record of enforcing private contracts 30. Under these circumstances, investment in long-lived and non-transferable assets was thought too risky for many private firms. Finally, foreign ownership of assets would have been controversial and might have led to greater unrest. For these reasons, the government adopted a scheme that would involve little private investment.

Although radical reform eventually occurred, it was not implemented until six years after the initial studies and five years after the change in government. Overall, it is not surprising that the Touré regime did not implement significant reform. Unlike the military government that replaced it, the Touré regime was highly dependent upon the two groups that would be harmed by reform. Any reform that resulted in increased prices, especially of the magnitude actually implemented, and layoffs would harm the regime's main support base and, therefore, would have been hardly feasible. In contrast, the five-year lag following the change of government reflects the slow pace of structural adjustment and, more generally, political instability in the early years of the new regime 31. Consequently, sensitive reforms that would harm urban residents, such as realigning the exchange rate and civil service employment reductions, were approached cautiously (see Clapp 1994, 1996). After years of repression and shifting policies under the Touré regime , it was going to take some time for adjustment to result in increased agricultural production and improved welfare in rural areas.

Since President Touré was careful about making sure that rivals could not build effective power bases while he remained president, the new military leaders were unable to build support before taking power. Consequently, while the new leaders were forging a coalition, they remained heavily reliant on the military and on goodwill conferred to them for ending President Touré's more repressive policies. Since the benefits of structural adjustment would take a reasonable time to materialize, it is not surprising that the new government was careful about implementing reforms that could initiate protests.

Water reform was finally adopted in 1989. World Bank requirements meant that the private partner had to be selected through international bidding and six companies initially expressed interest:

Two bidders dropped out during the process and the four remaining companies combined to form two competing consortia. A joint venture led by SAUR, with the participation of Compagnie Generale des Eaux, submitted the lower bid for tariffs that they would charge consumers, which was 30% below the consultant evaluation of the tariff level that would ensure cost recovery. SAUR quickly confirmed its leadership in the newly formed company with the help of experts from Cote d'Ivoire, where SAUR had been successfully involved in the water sector for nearly 30 years (see Ménard and Clarke 2001). New contracts were formally signed in 1989 and were supported by the World Bank coordinated Second Water Supply Project 32.

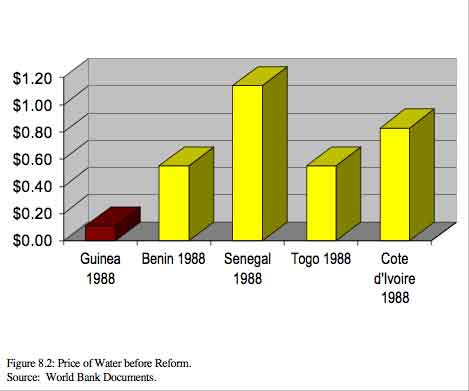

As part of the reform, two enterprises were created: Société Nationale des Eaux de Guinée (SONEG) and Société d'Exploitation des Eaux de Guinée (SEEG). The reform involved a set of three contracts: one between the Government and SONEG (Contrat plan); one between SONEG and SEEG (the lease contract); and one between SEEG and its international shareholders (a technical assistance contract). In addition, there were contracts between SEEG and its customers, i.e., users of the water system. Formally, the relationship between SONEG and the government was monitored through a contract. At the time of reform, the contract defined rules governing the determination of tariffs (see below) and committed the government to pay its bill regularly. It was the only contract that defined specific targets, namely, the increase of connections, from an estimated 16,400 in 1989 to 20,200 in 1992.

The lease contract defined the responsibilities of SONEG and SEEG. SONEG owned sector assets and was responsible for planning, projecting and managing infrastructure, sector accounting, and managing funds from the ‘rental fee' and donors to pay for new investment and service sector debt. Since the rental fees paid to it by SEEG were supposed to cover its operating and debt service expenses, it was financially independent of the Government. It was also responsible for supervising most large-scale investment (e.g., reservoirs and transmission pipelines) and for the construction and maintenance of the primary distribution network (i.e., pipes more than 160 mm in diameter). One significant restriction was that SONEG could not finance investment through borrowing; this was the responsibility of the government. Although SONEG was formally an independent agency, its board was under direct Government control, with members appointed by different ministries 33. In addition, the government also appointed its staff, including its Directeur Général. SONEG was further constrained by its reliance upon foreign suppliers (including SAUR, SEEG's leading shareholder). SEEG, which was 49% state-owned and 51% privately owned, had a ten-year lease contract with SONEG. SEEG was in charge of the distribution and commercialization of water, including building and maintaining the secondary and tertiary distribution networks (i.e., pipes under 160mm in diameter); metering, billing and collecting; and paying the rental fee to SONEG. As we noted above, the private owners were two French companies, SAUR (a subsidiary of Groupe BOUYGUES, a French company heavily involved in public works), which had the leadership in this arrangement, and Compagnie Générale des Eaux (CGE, now Vivendi). In addition to the lease contract, the two French partners signed a “technical assistance contract” with SEEG to provide managerial support, technical assistance and financial expertise, and to help train Guinean personnel 34. As their contribution to SEEG, SAUR and CGE provided 51% of the initial US $3 million of capital. For its contribution, the Government donated equipment and infrastructure from DEG and, through SONEG, took responsibility for accumulated sector debt.

Notwithstanding the presence of five government-appointed representatives on its eleven member Board, SEEG acted like a private company. The private owners were responsible for nominating the General Manager, while the government was responsible for choosing the Chairman of the Board. Several factors increased SEEG's autonomy. First, the foreign management's close ties to SEEG's international owners significantly reduced Government influence. In addition, the contractual arrangement, which put SEEG in charge of bill collection, gave SEEG direct control over the financial resources it needed to operate.

The division of investment responsibilities between the two agencies led to significant problems, with the two agencies blaming each other for delays and disagreements. The different priorities and constraints that the two agencies faced were part of the problem. Because SONEG tended to be more concerned with social and political goals, while SEEG had commercial goals, they often disagreed on priorities concerning network expansion. Further, SONEG, as a public agency, had to follow public procedures when making investments, (e.g., awarding large investment contracts through bidding). SONEG's processes were often slow and costly and provided opportunities for public interference, corruption, and delay. In contrast, SEEG, as a private company, had much greater flexibility and, consequently, SEEG tried to go over SONEG's head, developing infrastructure beyond its contractual responsibilities. Although the contract explicitly prohibited SEEG from doing this, once it was done the situation was irreversible. When the Caisse Française de Développement provided SEEG with substantial aid to develop new infrastructure (without bidding and ignoring the clause that makes SONEG responsible for such projects), SONEG could do little. Further, despite SEEG's role in investment, SEEG assumed almost no investment-related risk – loans for infrastructure were the responsibility of the Government.

Implementation of the contract between SONEG and SEEG was made more difficult by low administrative capability and the absence of an independent judiciary. This meant that no impartial body was able to constrain arbitrary action by the government and credibly enforce contracts provisions. For example, recognizing that SEEG could apply pressure to SONEG by refusing to pass SONEG the rental fee, the contract allowed SONEG to seize a deposit paid by SEEG if this occurred. However, political interference by the government prevented SONEG from doing this. For example, when the government stopped paying its water bill (see Figure 8.6), SEEG stopped passing SONEG the rental fee on the money it was collecting from the private sector, formally a breach of contract. In turn, this threatened SONEG's ability to pay employees, reimburse international lenders and continue with investment. However, when SONEG threatened to impose the penalty, SEEG, backed by its international owners, argued that the delay was due to non-payment by the government and government representatives forced SONEG to back down. Ultimately, under pressure from international donors who made settlement a condition for credit effectiveness for the Third Water Supply and Sanitation Project, SEEG and SONEG significantly reduced their cross-debts on September 26, 1996 35.

This episode demonstrates that contract provisions designed to prevent certain government actions will not be useful unless an independent body can enforce the contract and prevent the government from taking retaliatory action. Although the lease contract explicitly allowed SEEG to cut water to government entities that were more than four months late with payments, SEEG was unwilling to actually cut off water to any agencies of the Central Government. In part, SEEG's unwillingness reflected its concerns about its relationship with the government, since the central government has significant power over SEEG 36. For example, at that time, SEEG was trying to get the government to pass a law that would allow it to force collection for non-payment by private parties and to approve price increases larger than had been originally planned.

Another effect that weak institutions had on outcomes was the apparent failure of several mechanisms directed at dispute resolution. First, the government, which owned 49% of SEEG, had representatives on the boards of both SEEG and SONEG. It was hoped that this would improve coordination between the two enterprises. In fact, it did the opposite by introducing ambiguity about whether the contract was open to repeated renegotiation. Second, the arrangement allowed the two parties to appeal to the judiciary in Guinea and, ultimately to an international institution, the Centre International pour le Règlement des Différends Relatifs aux Investissements (CIRDI), in cases of major dispute. The clause was intended to reassure foreign investors concerned about the lack of institutional constraints on arbitrary government action (e.g., the weak judiciary). In practice, however, the clause was almost purely symbolic. It was not possible to solve everyday disputes and disagreements through an international forum and, since turning to international arbitration would suggest major failure to foreign investors and international organizations, it was difficult to use for even major disputes. Further, in the absence of an independent judiciary, it was unclear how CIRDI could enforce it decisions, if it ruled against the Government.

In practice, therefore, problems were largely solved though informal negotiations between top managers – making the persons in charge crucial – or through political interference (e.g., when SONEG tried to impose the penalty for not paying it the rental fee). Political interference, however, was costly.

First, it introduced bias and could result in delayed and unpredictable outcomes. Second, as noted above, these problems poisoned relations between SEEG and SONEG, making it more difficult for the two companies to work together.

Water reform is more likely to succeed if an efficient and credible regulatory entity with the capacity to force the partners to fulfill their commitments is developed. This did not happen in Guinea. In the absence of an independent regulator, the efficient running of the system depended on the set of contracts and their implementation. SONEG, who was officially responsible for monitoring SEEG, was not able to do this due to its lack of autonomy and to information asymmetries between SONEG and SEEG. SONEG's lack of autonomy meant that major decisions and conflicts went to the cabinet of the Ministry of Natural Resources and even to the President of the Republic. Consequently, the government had significant discretionary power that was only partly counterbalanced by donors and the powerful international companies that owned SEEG.

This discretionary power created uncertainty for SEEG, since SONEG's plans and their implementation depended upon political decisions. Since SONEG planned, contracted, and monitored the development of the primary network, SEEG had to rely upon SONEG to do this before it could develop the secondary network. However, there was the risk that the government might divert SONEG's rental fee to fund other non-sector related spending, meaning that needed investment in the primary network was not performed. Further, the bureaucratic process for SONEG's investment program meant that the government could use bureaucratic delays to improve its bargaining position or disguise other motives. This encouraged SEEG to make investments that should have been made by SONEG (e.g., in the primary network) and to skirt rules (e.g., by splitting large investment into small parts to avoid public control).

However, weak regulation could also work in SEEG's favor. For example, since the distribution network included both lead pipes installed in the 1950's and newly installed PCV pipes, maintenance costs were difficult to observe. Since SEEG was responsible for maintaining the secondary network, it could potentially overstate these costs. An additional problem was that SEEG also bid on construction contracts and, since it did not produce separate accounts for its separate functions (e.g., those that should be regulated and those that were not), it was difficult to assess the profitability of the lease contract. These informational asymmetries were aggravated by SEEG's refusal to provide SONEG with the reports and information, including separate accounts, which the contract required.

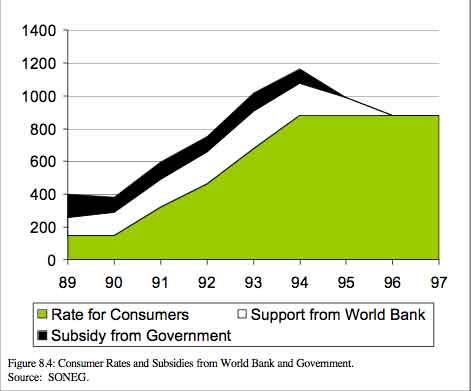

As noted above, one of the major goals of reform was to make the sector financially self-sufficient within six years. Since, as noted earlier, prices were thought to be below long-run marginal cost, large tariff increases were necessary. Recognizing that this would be difficult for political reasons, the government agreed to heavily subsidize prices for six years following reform through a World Bank credit. Consumer tariffs were immediately increased to 150 FG/m3 in 1989 (about $0.25/m3) to cover local currency costs, including the local currency operating costs of SONEG. However, the foreign currency costs (e.g., for imported equipment and supplies) were covered by proceeds from a World Bank loan and the government continued to service part of sector debt 37. These subsidies slowly declined until 1995, by which time the consumer tariff was supposed to cover all costs (see Figure 8.4). It was thought that this would imply an average price to consumers of 660 FG/m3 in 1995, which would fall to 566 FG/m3 in 1998 (Triche 1990). In practice, prices have been considerably higher.

Prices were regularly revised, in accordance with a cost index formula. In addition, SEEG had to renegotiate its rate with SONEG and the government every four years, based on an informal cost plus formula 38. The renegotiations were intended to give SEEG a short-term incentive to cut costs, since it could keep cost reductions between negotiations, while allowing consumers to benefit in the medium-term. Although there was initially concern that the government would not increase tariffs enough to “ensure sound sector development” (World Bank 1989), this was not a problem in practice. In fact, prices were allowed to increase far more quickly than originally planned. By 1996, the average tariff had reached 880 FG/m3, compared to an expected price of GNF 660/m3. The difference between actual and projected tariffs was not the result of higher than anticipated inflation. Figure 8.5 shows that the price has grew faster in real terms than originally projected 39.

At the end of 1997, the minimum bimonthly payment for service was 13500 FG (about US$13). This fixed payment included payment for the first 20 cubic meters of water and had to be paid in full whether the household consumed the whole 20 m3 or not. The price of water between 20 and 60 cubic meters was 850 FG/m3 and the price above 60 cubic meters was 925 FG/m3. In addition, it cost 90,000 FG (about US$90 in 1996) to be connected to the system. Given that the average income of a high public servant was only about 150,000 FG (about US$150 in 1996) a month, these amounts were substantial. In field interviews, even relatively wealthy persons claimed that the high prices made it difficult for them to afford connections, especially due to the social custom of providing free water to family and neighbors. Possible reasons for the high price are discussed in the next section.

Despite the problems with conflict resolution and overlapping responsibilities, there is no doubt that reform resulted in a significant improvement in sector performance. However, given the disastrous performance before reform, the results were not as dramatic as was originally hoped and significant scope for future improvement remains. In this section, we analyze the mixed results and suggest some explanations.

Although it was hoped that the sector could become self-supporting in the medium term through increases in tariffs, funds for investment and rehabilitation were needed immediately. Consequently, international donors led by the World Bank agreed to finance a large investment project, the Second Water Supply Project, that had four main investment components.

Although the new pipeline from Grande Chutes dramatically increased potential water production, from 54,000 m3/day in 1988 to 100,000 m3/day by the end of 1993 (World Bank 1998), actual production has been far lower. Average daily production was 60,345 m3/day in Conakry in 1996, while average billed consumption was only 30,255 m3/day, reflecting the high levels of UFW 40.

Consequently, if the rate of UFW could be reduced to around 20%, current productive capacity should adequately service needs in the near-term even if the number of connections increases significantly.

Although the number of legal connections increased after reform, the increase was slower than anticipated and coverage remains low 41. By 1997, there were about 31,000 connections in Guinea, including about 25,000 connections in Conakry (population of about 1.7 million) 42. In comparison, there were close to 180,000 connections for 2.7 million inhabitants in Abidjan, Côte d'Ivoire (SODECI 1996). The low connection rate reflected economic, technical and institutional factors. First, as discussed below, many residents could not, or would not, pay for water due its high price. In 1994, it was estimated that nearly 12,000 connections were inactive due to non-payment (Brook Cowen 1996). Second, Conakry's chaotic, unplanned development, which was aggravated by the large and sudden inflow of refugees from civil wars in neighboring Liberia and Sierra Leone, made network expansion technically difficult. Finally, disagreements between SEEG and SONEG, which were responsible for complimentary portions of investment, also slowed system expansion.

Although the number of standpipes increased following reform, they remain uncommon. There were about 130 standpipes in Conakry in 1997, including some that were inactive, resulting in 9,050 non-connected residents per standpipe. During field interviews, SEEG officials stated that SEEG did not want to manage standpipes, arguing that the widespread belief that water from standpipes should be free damaged their public relations. Consequently, although SEEG installed standpipes when asked by a Commune (municipal government), it would not manage them. Instead, the Commune and SEEG jointly selected a manager, who collected user charges that he paid to SEEG. SEEG then returned a share to the Commune to cover access charges and employee benefits. In practice, since managers were often unable to resist pressure for free water from neighbors and were sometimes corrupt, they collected little money from users leaving the municipal government to foot the bill. If the Commune did not pay, SEEG could, and did, cut the standpipes off.

The low connection rate meant that water-related health problems remained a major issue due to the large number of customers who consumed unsafe water from illegal connections and contaminated wells. Because of this, diseases related to unsafe water and inadequate sewerage remained the main source of mortality (in decreasing order: malaria, diarrhea, hepatitis A, poliomyelitis, and skin diseases) 43.

Most people agreed that water and service quality improved dramatically following reform. For example, the manager at the local Coca-Cola bottler noted that although water was muddy and discolored for several years after reform, regular tests confirmed that it met the standards imposed by their international headquarters by 1997. Further, the Organization for Consumer Protection in Conakry rated water quality as excellent and noted that it can be consumed as delivered (World Bank 1998). Similarly, a 1994 study that measured chemical and bacteriological contamination in piped and well water, concluded that piped water in Conakry complied with WHO norms for drinking water (Gélinas et al. 1996).

The reform also improved customer service. To make it easier to file complaints, apply for new connections, notify SEEG about needed repairs and pay bills, SEEG divided Conakry into three districts, each with its own director. In addition, SEEG invested in light equipment (e.g., motorcycles) so that they could collect bills more efficiently and respond more quickly to repair requests. Further, SEEG's detailed computerized map of the network and final connections made it easier to locate disruptions. Delays for new connections were reasonable, although consumers complained about SEEG's policy of waiting until a large group of consumers paid deposits before expanding the network.

Similarly, although some people complained about delays with repairs, most agreed that this was not a major problem.

Following reform, SEEG rapidly metered households, businesses, and the administration. Before reform, despite metering projects funded by the World Bank and other international donors, only about 5% of customers had working meters. By 1996, 98% of private customers and 100% of administration connections were metered.

Metering significantly reduced the amount of water billed to the government. In 1990, the first full year of private operation, estimated government consumption was close to 7.5 million m3 of water. In 1996, measured government consumption was about 3.6 million m3. Most of the decline was probably because government consumption was overestimated before metering and because responsibility for standpipes was transferred from the central to municipal governments 44. However, since government consumption continued to decline even after public metering was completed in 1995, it appears that the government also reduced its consumption 45. Before 1989, DEG billed the Government centrally and, therefore, individual agency within the government had little reason to use water efficiently even when they were metered. Following reform, each agency became responsible for its own water bill giving them reason to use water more sparingly (e.g., reporting breaks and leaks more quickly). In practice, however, non-payment weakened these incentives.

Although bill collection from private consumers improved significantly after reform, it remained low compared to other privately operated systems (e.g., the private collection rate is 98% in Abidjan, Côte d'Ivoire). Further, as the price to consumers increased, the collection rate fell – from 75% of the amount billed in 1989-90 to under 50% in 1991-1992. It recovered in 1993 and remained at around 60% through 1996 (see Figure 8.6). SEEG could, and did, cut off customers who did not pay their bills for three consecutive months 46.

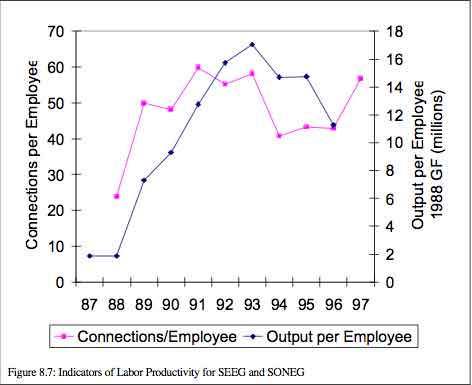

Another improvement was that labor productivity increased at the time of reform (see Figure 8.7).

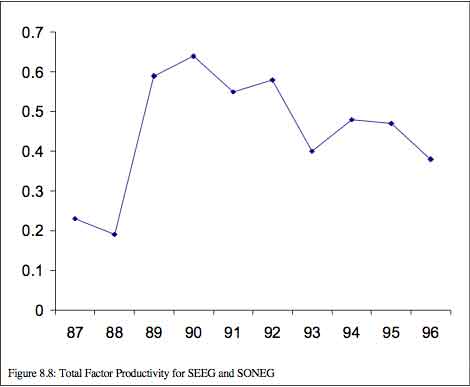

The rapid improvement was primarily due to a reduction in the number of workers immediately followed reform. After this, connections per employee failed to increase significantly and actually dropped between 1994 and 1996. The increase in 1997 was due to a large increase in the number of connections that year (23,435 in 1996 compared to about 31,000 in 1997). A second measure of productivity, output per employee, followed a similar pattern 47. Total factor productivity also increased at the time of reform (see Figure 8.8). However, after this, TFP slowly declined (although it remained considerably higher than before reform). The most noticeable decline was a large drop in 1993, due to the large increase in fixed capital due to investment in the Grandes Chutes pipeline. Since a large part of productive capacity remained unused by the end of 1997, due to the slow development of the distribution network, total factor productivity should increase as the distribution network expands.

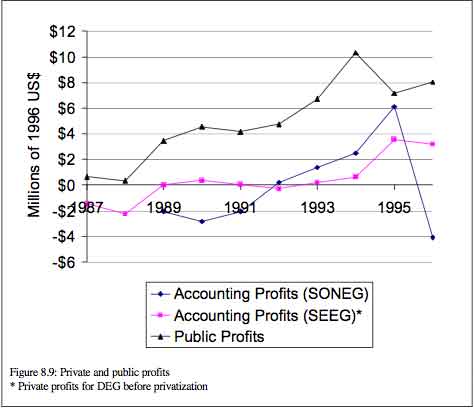

Given the improvements in billing, collection and productivity and the large increases in tariffs, it is not surprising that the sector's financial situation improved dramatically following reform, despite a drop in subsidies. Whereas DEG was losing large amounts before reform, SEEG quickly became profitable (see Figure 8.9). By 1996, SEEG's profits reached GF 3.2 billion ($3.2 million in 1996 dollars). The increase in SEEG's accounting profits after 1993 coincided with a decrease in the ‘rental fee' that SEEG paid to SONEG. Although the average consumer rate remained at GF 880 between 1994 and 1996, the share of the tariff that SEEG paid to SONEG fell from GF 527 in 1994 to GF 370

in 1996.

In 1989-90, SONEG lost about $2.8 million (see Figure 8.9). After slowly improving through 1995, SONEG's operating profit became negative (-$4.1 million) once more in 1996. The decline was due to the sharp drop in the ‘rental fee' that SEEG paid to SONEG and the end of the subsidy that the government paid SONEG for debt service (GF 88/m3 in 1994). Although SONEG appeared profitable in 1995, this was due to a large increase in non-operating income (from GF 396,000 in 1994 to GF 9.6 billion in 1995). Without this, SONEG would have shown losses of close to $3.7 million in 1995.

Although sector performance improved along many dimensions, some problems remained. First, as noted in the previous section, many changes were modest, especially considering the poor initial performance of the sector. Second, other performance indicators, including unaccounted for water (UFW) and public collection rates, failed to improve. Finally, prices increased dramatically, resulting in many complaints from consumers. As noted earlier, although it is difficult to compare prices across cases, tariffs are high in Guinea compared to the other countries in this study. In this subsection, we discuss these remaining challenges.

By 1996, when 95 percent of connections were metered, UFW stood at about 48% (World Bank 1998). Although due to the highly variable estimates of UFW before metering was complete it is difficult to say whether UFW improved, it remained high compared to either international standards (between 10 and 20%) or to other systems in West Africa (see Figure 8.10). Several physical characteristics of the system contributed to this. First, in sections of the city where old pipes were buried only a few inches underground, it was easy to connect to the system illegally and pipes could be easily broken (e.g., by heavy vehicles). Second, overlapping lots and interlaced households made it difficult to interrupt water supply and control connections. Finally, poor maintenance and ancient infrastructure contributed to the problem.

However, institutional factors also contributed. Officials from SEEG noted that it was difficult to prosecute persons with illegal connections and, therefore, the company could do little to deter this behavior other than cutting illegal connections off. In addition, the contractual arrangement gave SEEG, which was responsible for a substantial share of maintenance, little reason to reduce UFW. Since the expansion of the Grande Chutes pipeline meant that potential production outstripped both consumption and actual production, SEEG could increase connections without reducing UFW. Moreover, SEEG paid the rental fee to SONEG based on bills collected, not on water produced and delivered by SONEG. Since SEEG did not pay for raw water and did not lose sales due to UFW, it had little incentive to take costly actions to reduce it.

Some experts argue that reducing UFW is not that important in Conakry, considering the considerable water resources available and the high cost of a significant rehabilitation program. Although SEEG's accounts were not detailed enough for precise estimates, since the system is gravity-fed and most costs (e.g., provisioning and debt service) do not depend upon the quantity of water provided, short run marginal costs were probably quite low. For this reason, it was probably not efficient in strict economic terms to spend significant amounts to reduce UFW. Although with hindsight it might be argued that the productive capacity added under the Second Water Project could have been delayed if UFW had been reduced, this was not clear when the project was proposed. UFW was thought to be considerably lower before metering was complete and, therefore, consumption was thought to be close to productive capacity 49.

Despite these arguments, the high rate of unaccounted for water might be costly in other ways. First, UFW can cause pollution and disease, especially when drainage is poor. Water obtained through illegal connections is poor quality, especially when stored in unsanitary conditions, and leaky pipes can affect water quality through the entire system. Second, it is hard to convince people of the long run economic cost of water and, therefore, the necessity of paying for it when they know that large amounts are simply being wasted. Finally, the high rate of UFW reflected other problems in the system – most notably, the poor quality of the infrastructure and the inability, or unwillingness, of the population to pay for water.

Another problem was the low collection rate from the public sector. Although the private operator was not to blame – the collection rate was low before reform and a private operator can do little to force an unwilling government to pay in a weak institutional environment – this was clearly a problem. For the first two years of the lease, under donor pressure, the government paid its bill regularly (see Figure 8.6). However, in 1991 the government collection rate fell to less than 50%, and then dropped further, to close to 10%, in 1993. Since the government accounted for about 30% of sales – and more before 1996 – this was a significant problem for the private operator. Further, large fixed costs were passed on to a small number of private consumers who actually paid their bills, increasing prices significantly (see below).

The most common complaint during field interviews was that the price of water was too high 50. In general, it is difficult to compare prices across countries. First, tariff schemes vary greatly across countries – for example, it is hard to compare prices in countries that are fully metered with those where customers pay lump-sum tariffs. Second, the cost of providing water also varies greatly between countries. For example, whereas the water system in Conakry is gravity fed, water in Mexico City has to be pumped from a source that is 140 kilometers away and 1000 meters below the city. On the other hand, Conakry's system is far smaller and less dense than the systems in the other cases, increasing costs in Conakry. Finally, water systems are often heavily subsidized, often in non-transparent ways, making comparisons even more difficult. Unlike systems in many other developing countries, Conakry's system provides sufficient revenues to cover operations and maintenance and service sector debt.

Finally, since prices are adjusted infrequently, and exchange rates in Africa are often unstable, it is difficult to compare prices in US dollars at a single point in time.

With these provisos, however, prices in Guinea appeared high, compared to prices the other cases in this study (see Figure 8.11). Further, prices in Guinea were higher than average, although not completely out-of-line with, other African countries (see Figure 8.11). Finally, the tariff for low-income consumers in Guinea was high compared to tariffs for similar consumers in other countries. For example, although the average tariff in the mid-1990s was higher in Uganda than in Guinea ($0.96 vs. $0.84), the metered tariff for domestic users was lower in Uganda than the social tariff for low-income users in Guinea ($0.57 vs. $0.64).51

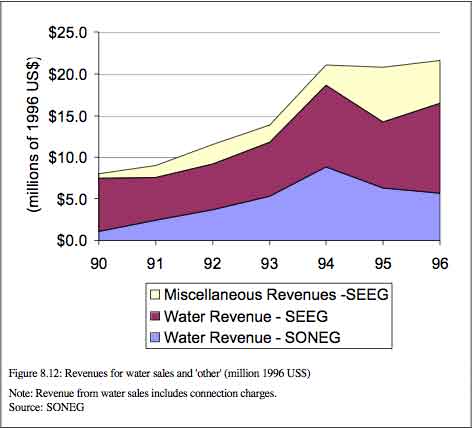

It is hard to assess why prices were higher in Guinea than in other African and Latin American countries. Figure 8.12 show the division of both revenues from water sales and total revenues for the post reform period. SEEG received a greater share of both total revenues and water revenues than SONEG (about 65% of water revenues and about 74% of total revenues in 1996). Since SONEG financed most of its activities through grants and loans, this is not surprising (see Clarke et al. 2000).

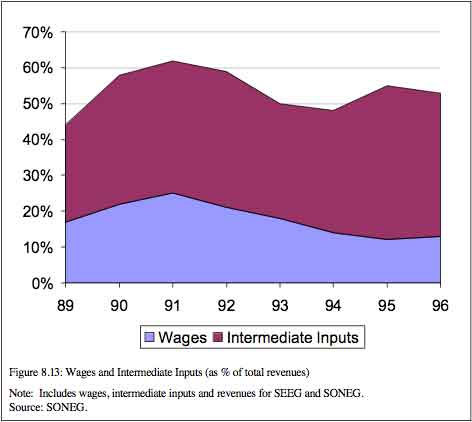

Expenditures on wages and intermediate inputs for SEEG and SONEG combined consumed between 48 percent and 62 percent of total revenue between 1989 and 1996 (see Figure 8.13). Since SEEG was far larger than SONEG (500 employees at SEEG compared to 44 at SONEG in 1997), expenditures on wages and intermediate inputs were primarily expenditures by SEEG. In 1996, SEEG accounted for 90% of total wage expenditures and 87% of expenditures on intermediate inputs.

According to field interviews, the salaries for the five expatriate managers at SEEG accounted for about 15% of expenditures on wages and salaries in 1994-1995 (i.e., only about 1.6% of total revenues). Consequently, they were clearly not the main cause of the high price of water.

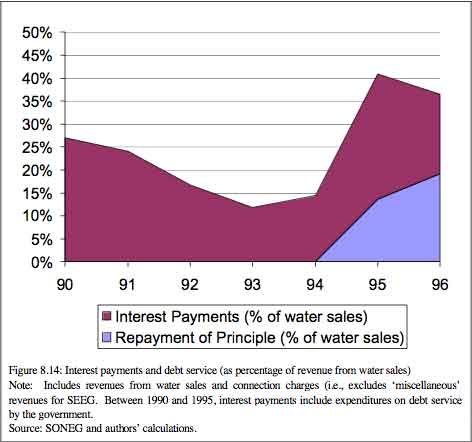

By 1996, interest payments and repayment of principle consumed, respectively, about 17% and 19% of revenues from water sales (see Figure 8.14). We compare interest payments and the repayment of principle with revenues from water sales, rather than total revenues, because these payments were made by SONEG, which receives revenue only from water. Between 1990 and 1996, interest payments on sector debt increased from about $2.0 to $2.8 million (in 1996 US$) 52. Since 1996, principal repayment on loans from the Second Water Supply Project has increased and new loans have been taken out under the Third Water Supply and Sanitation Project. Consequently, interest payments and principal repayment were projected to increase significantly after 1996 – SONEG projected that interest and principal repayment would increase by 226 percent by 2005. Hence, without large increases in coverage or prices, the share of revenue consumed by debt service is likely to grow.

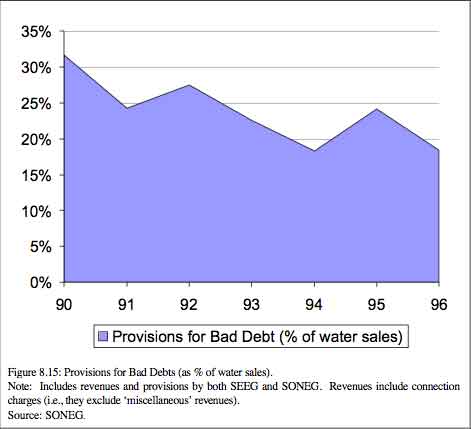

As discussed in the previous section, both public and private collection rates, although higher than they were before privatization, were consistently low. Therefore, provisions for bad debt consumed a large portion of revenue. In 1996, provisioning for bad loans cost SEEG and SONEG about $3.0 million (in 1996 US$) – about 18.4% of revenue from water sales (see Figure 8.15). In comparison provisions for bad debt accounted for only about 2.8% of SODECI's pre-tax revenues in Côte d'Ivoire. Improving billing, through both improving government payment and making it easier to collect from non-paying private customers, would allow substantial price reductions.

Given that the government accounted for a significant part of the non-payment problem, one way to ensure lower prices would have been for the government to pay its water bill in a timely manner. Similarly, legal reform that would make it easier for SEEG to prosecute people who connect illegally or who refuse to pay their water bill would have also reduced financial pressure on the two companies. A bill to that effect, which presented by the government under pressure from international donors, was killed by the Parliament in 1996. This event illustrates the importance of political pressure on pricing and collection issues, even when the private sector is involved in the sector.

This section presents a brief description of results from a cost-benefit analysis based upon the methodology in Jones et al. (1990) and Galal et al. (1994). In the analysis, we compare the actual performance of the sector following reform (the ‘actual' scenario) with expected performance if the reform had not taken place (the ‘counterfactual' scenario) for the ten years following reform.53 Clarke, Menard and Zuluaga (2000) present a complete description of the welfare analysis, including data deficiencies, other problems and a sensitivity analysis.

We believe that the results in this section present a conservative estimate of the benefits of the reform for two reasons. First, we are not able to assess the potentially large benefits to consumers from improved service and water quality since it is difficult to value these gains. Second, the counterfactual relies heavily upon DEG's pre-privatization accounts. Since the unaudited accounts probably overstate DEG's success, we are likely to overestimate performance in the counterfactual scenario and, therefore, underestimate the gains from reform. For example, since we are using DEG's profit and loss statement, which records transactions as billed, we implicitly assume that DEG would have actually collected (or provisioned for) the amount billed. However, DEG had a poor collection record and provisioning appears inadequate. Since we rely upon these figures to construct the counterfactual, and because we omit the gains from improved quality, the estimated gains from reform should be seen as a lower bound on its likely effect.

We estimate consumer surplus for three categories of demand: water supplied to private consumers, water supplied to the government, and connection fees 54. Although, under ideal circumstances, we would like a finer breakdown for demand, this is impossible because neither revenue nor volume of water billed was broken down more finely. Since neither SEEG nor DEG was responsible for providing sewerage services, we do not include sewerage in this partial equilibrium analysis. In the analysis, we assume a high price elasticity of demand (-0.6), although, in practice, the results are similar for a large range of assumptions about demand and price elasticities (see Clarke et al., 2000). Following Galal et al. (1994), we subtract connections fees from consumer surplus for water consumption. The implicit assumption is that consumers gain utility from water usage, not from the connection itself. Hence, potential consumers compare the net present value of consumer surplus from usage with the connection fee and the stream of tariff payments.

In this case study, the counterfactual scenario differs from the actual scenario in the following ways. First, we assume that the World Bank supported Second Water Project would not have been approved and that, therefore, investment would have remained low. Second, we assume that labor productivity would remain poor. Third, we assume that the large price increases that followed reform would not have been implemented. Finally, given the above assumptions, we assume that the government would have increased subsidies to cover DEG's operating losses on a cash-flow basis.

This final assumption is necessary given the second and third assumptions.

The assumption that the World Bank would not have approved the Second Water Project without some degree of private sector participation is supported by World Bank documents and discussions with World Bank staff involved in the project. Since most investment was supported through donor funding, we assume, therefore, that DEG would only perform sufficient investment to maintain assets (i.e., that investment would be equal to real depreciation). Because of this, there is no output growth in the counterfactual scenario. This is consistent with two observations. First, since average daily production in Conakry was about 45,000m3/day and maximum average production was estimated to be 54,000m3, little system expansion would be possible in Conakry without upgrading productive capacity 55. However, the expansion of the production capacity would not have been possible at the observed level of investment in the late 1980s 56. Second, between the end of the First Water Project (1984) and the start of the Second Water Project (1989), there was little or no system expansion 57. Since assumed investment under the counterfactual is slightly lower than the observed average investment in 1987 and 1988, the assumption of no expansion seems generous 58.

In the welfare analysis, we assume that the improved productivity observed following reform was a result of the reform. This seems reasonable, since there is little evidence of increased productivity before reform. Although poor data quality makes it difficult to assess factor productivity accurately prior to 1989, estimated consumption and the number of connections were falling and the number of staff was steady in the mid 1980s, suggesting labor productivity was falling.

We assume that the large price increases observed following reform were contingent on reform. This is reasonable for several reasons. First, given DEG's poor collection performance when prices were low, it seems unlikely that DEG would have been able to collect billed amounts if prices were raised.

Second, it seems unlikely that consumers would have borne the price increases without corresponding improvements in quality, which would have required additional investment. Finally, in the actual scenario, the private operator has an incentive to push the government and SONEG for price increases. This motivation would have been missing under public ownership. In fact, most increases in the 1970s and 1980s appear to have been implemented only under donor pressure. Consequently, under the counterfactual scenario of continued public ownership, with no additional donor funds for investments, we assume that prices would have stayed constant in real terms at the 1988 tariff rate.

Before reform, even after the large subsidies DEG received from the Government, DEG was losing large amounts of money. These large losses would have been unsustainable without additional borrowing or an infusion of capital from the government (i.e., an increase in the subsidy). DEG's financial position was too weak to borrow significant amounts from private capital markets and donors such as the World Bank generally do not lend money to finance operating losses. Therefore, we assume that the government would have increased the subsidy to make the company's cash flow close to zero. In the counterfactual scenario, therefore, subsidies increase from $3.15 million in 1988 to $4.4 million in 1996 (in 1996 US$). This assumption means that subsidies are slightly lower in the counterfactual scenario than in the actual scenario through 1992.59 After 1992, subsidies stabilize at about $4.4 million in the counterfactual scenario, whereas they drop to zero in the actual scenario.60

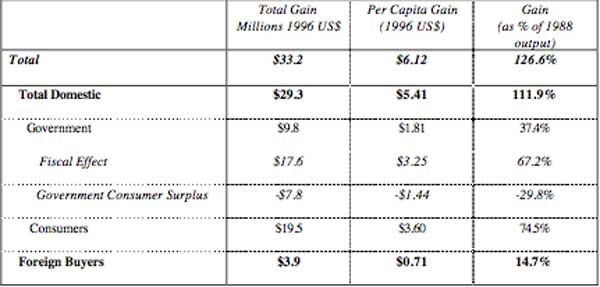

Table 8.1 presents results from the welfare analysis. Under the scenario described above, the total welfare gain was over $33 million (in 1996 dollars), with most of this accruing to domestic parties. Even ignoring the presumably large gains due to improvements in service and water quality, private consumers benefited considerably from reform. Although the large price increase might have reduced the utility of connected customers, especially those disconnected for non-payment, this appears to have been more than offset by gains accruing to new consumers.